is a car an asset for fafsa

YES theyre an asset. What assets are not counted for FAFSA.

Fafsa For 2022 Income Limits Types Of Aid And More Student Loan Hero

But in many situations reporting your.

. At that time the allowance for single parents aged 65 was 84000. In several situations there is not a requirement to report. DONT include these investments as assets on the FAFSA.

Distributions from a mutual fund to pay for college will count as income on the FAFSA. If you read each. Shifting an asset from a reportable category to a non-reportable category can help shelter the asset on the FAFSA.

The net worth of assets is calculated by subtracting any debt owed on the asset from the asset itself. Financial need is also variable so it may change year to year based on your familys income and assets. The answer to whether FAFSA can verify whether the numbers you put down for your parents or your income assets and other costs contains a lot of gray area.

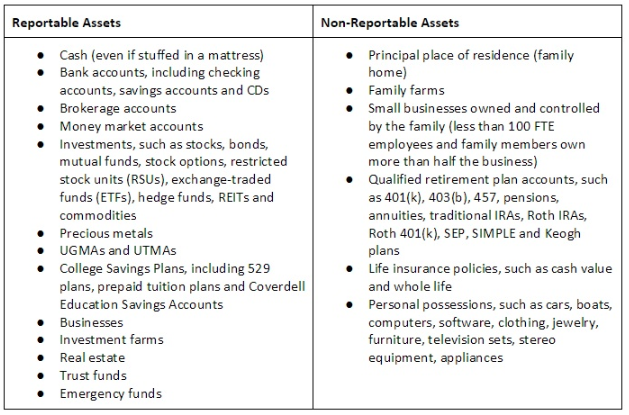

The Myth Of Asset Sheltering And Financial Aid Wealth Management How different assets are reported on the FAFSA. For example lets say your parents have a rental property that is valued at. Reportable and non-reportable assets are illustrated in this table.

You can also purchase items that your student will need for school. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA. The asset protection allowance peaked in 2009-2010.

If they will need a car or a computer for college consider buying it before you submit your FAFSA. The value of life insurance. 529s owned by your ex-spouse.

And distributions from it are student income in the year theyre received. First its important to note that parental assets and the. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA.

NO its not an asset on the FAFSA but it is on the Profile. The car also isnt reported as an asset on the FAFSA. In contrast the allowance for the same group was.

The car also isnt reported as an asset on the FAFSA. Commodities investments gold silver etc Qualified educational benefits or education savings accounts such as Coverdell savings accounts 529 college savings plans the refund value of. The car loan is not relevant to FAFSA calculations and cars are not an asset for their purposes.

However other students can. What assets are not counted for FAFSA. Parental vs student assets.

Any assets in the students name is assessed at a flat 20 percent rate. The car also isnt reported as an asset on the FAFSA. FREE Application for Federal Student Aid - Pass FAFSA Exam Easily.

Other items to include.

How To Ace The Fafsa And Maximize College Financial Aid

The 7 Trickiest Fafsa Questions And How To Approach Them

Don T Take Out Additional Student Loans To Buy A Car

Does The Fafsa Cover Graduate School And How Does It Work

9 Mistakes To Avoid When Filling Out Fafsa For Financial Aid Money

How To Manage Assets For Financial Aid Edvisors

Families With Assets Will Receive Less Financial Aid Next Year

How Assets Impact College Aid Eligibility On Fafsa And Css Profile Cjm Wealth Advisers

How To Shelter Assets On The Fafsa

How To Win At Getting College Financial Aid

Sweetening The Pot A Guide To Appealing Your Way To A Better Award Package Youtube

What Counts As An Asset On The Fafsa College Raptor

Fafsa Basics Parent Assets The College Financial Lady

How Income And Assets Affect Financial Aid For College Bankrate

How Assets Impact Financial Aid Wealth Management

Can You Use Fafsa Money To Buy A Car Common Questions Answered

How To Get More Money From Fafsa College Ave